Dodge & Cox's Strategic Acquisition of VF Corp Shares

Overview of the Recent Transaction

On June 30, 2024, the investment firm Dodge & Cox (Trades, Portfolio) executed a significant transaction by adding 6,974,220 shares of VF Corporation (NYSE:VFC), marking a notable increase in their investment in the company. This transaction increased their total holdings to 42,404,270 shares, with the shares acquired at a price of $13.50 each. This move not only reflects a substantial commitment to VF Corp but also represents a strategic enhancement of Dodge & Cox (Trades, Portfolio)'s portfolio, impacting it by 0.05%.

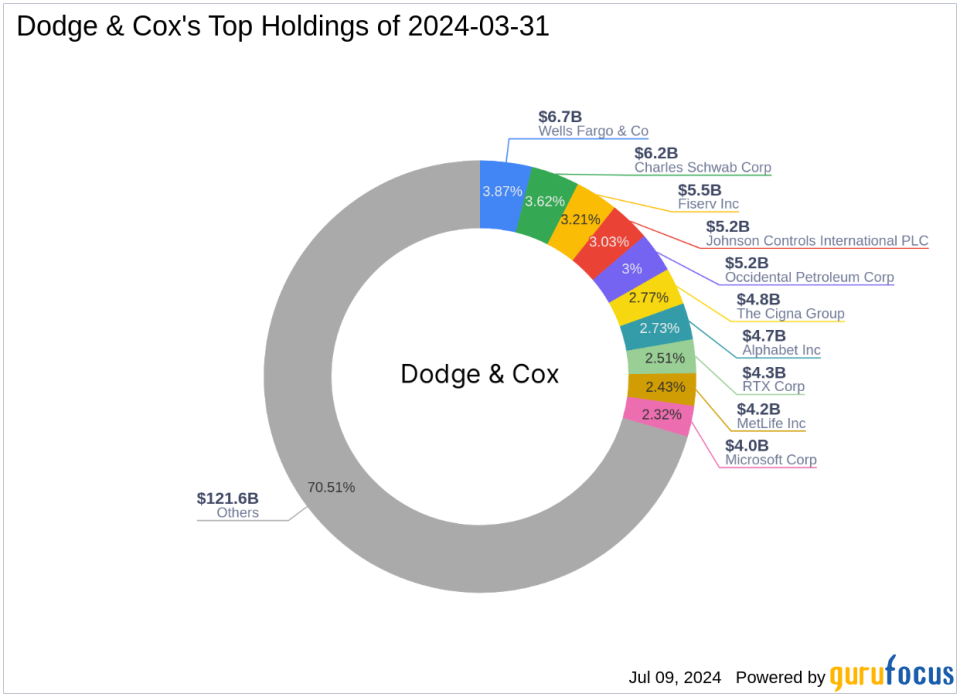

Insight into Dodge & Cox (Trades, Portfolio)

Founded in 1930, Dodge & Cox (Trades, Portfolio) stands as a prominent investment firm, renowned for its collaborative decision-making process and long-term investment horizon. The firm's investment philosophy is centered around achieving superior relative value and being cautious of overpriced popular assets. This approach has guided them through various market cycles, focusing on long-term capital appreciation by investing in undervalued companies.

About VF Corporation

VF Corporation, established in 1899 and publicly traded since 1966, is a key player in the apparel and accessories industry. The company owns a diverse portfolio of brands such as Vans, The North Face, and Timberland, catering to active, outdoor, and work segments. Despite its strong brand portfolio, VF Corp has faced challenges recently, reflected in its current market capitalization of $5.05 billion and a stock price of $12.98, which is significantly below its GF Value of $26.49.

Analysis of the Trade's Impact

The recent acquisition by Dodge & Cox (Trades, Portfolio) is not just a mere addition to its portfolio but a strategic move that could influence VF Corp's market perception. Holding a substantial 10.90% of VF Corp's shares post-transaction, Dodge & Cox (Trades, Portfolio) has reinforced its position as a major investor, potentially stabilizing the stock's performance amidst its current undervaluation and market challenges.

Current Market Valuation and Stock Performance

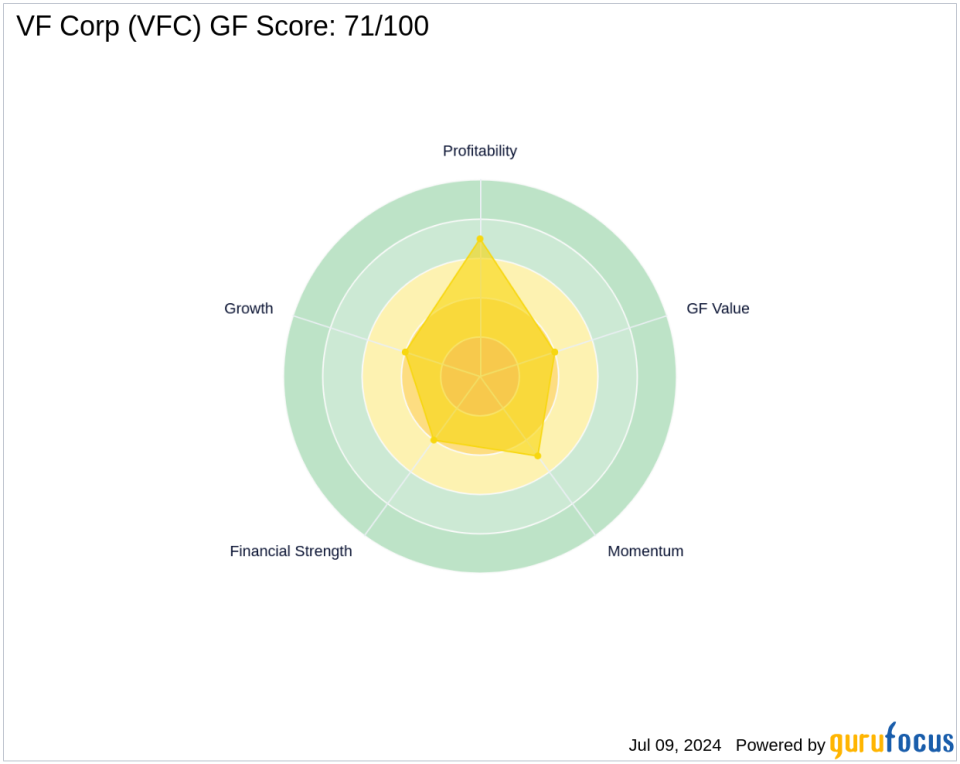

VF Corp's stock is currently trading at a significant discount, with a price to GF Value ratio of 0.49, indicating a potential undervaluation. However, the stock's performance indicators such as a GF Score of 71 suggest average future performance. The company's financial strength and profitability have been under pressure, as evidenced by its negative ROE and ROA figures.

Broader Market Implications and Other Notable Investors

This transaction by Dodge & Cox (Trades, Portfolio) might signal a bullish outlook to other investors, considering the firm's reputation for prudent and value-focused investments. Notably, other significant investors like Joel Greenblatt (Trades, Portfolio) are also stakeholders in VF Corp, although their investment strategies may differ. This collective interest from renowned investors could potentially lead to increased investor confidence in VF Corp.

Conclusion

Dodge & Cox (Trades, Portfolio)'s recent acquisition of VF Corp shares is a strategic move that aligns with its long-term investment philosophy and could have significant implications for both the firm's portfolio and the broader market. By increasing its stake in a historically strong but currently undervalued company, Dodge & Cox (Trades, Portfolio) is positioning itself for potential future gains, underscoring the importance of this transaction within the investment community.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.